Friday, June 30, 2006

Look what is happening?

More Action to Protect Traditional Knowledge

Ranbaxy Losses One More Time!

Thursday, June 29, 2006

Patent Terrorism – Terror of the Intangibles

Thursday, June 22, 2006

Dr. Reddy’s Rocks!

Newsletter – iPrex Solutions

Monday, June 19, 2006

Simvastatin Generic Brawl

Monday, June 12, 2006

Global Search for Software Patents: Is Google on eBay’s Auction?

Wednesday, June 07, 2006

Join Patent Café

Sasken 007: Licensed to Make a Killing!

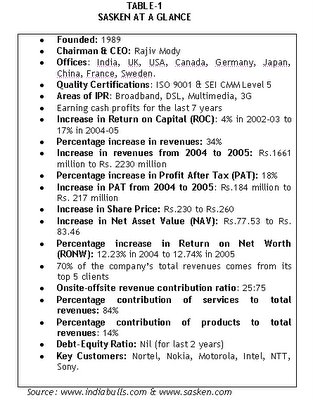

Company Background Sasken was founded by Mody in 1989 in a small garage in Fremont, California, from where it operated. Mody and four of his friends together invested $200,000 as initial capital to set up the company. Soon after its inception, Sasken was set up in Bangalore (India) in 1991. Offices were also established in San Jose. Sasken was initially registered in Gujarat as ASIC Technologies Pvt. Ltd. In 1992, the company changed its name to Silicon Automation Systems (India) Pvt. Ltd. In 1993, the company relocated its corporate office to Karnataka. In 1998, the company’s name was again changed to Silicon Automation Systems Ltd., and subsequently to Sasken in 2000. The name ‘Sasken’ is derived from a combination of the initial letters of its earlier name of Silicon Automation Systems, and the word ‘ken.’ ‘Ken’ implies knowledge, which is considered as the company’s primary driving force in the new knowledge era. Sasken is an embedded telecom solutions company that aids and expedites product development life cycles to businesses across the telecom value chain. Sasken, unlike other providers, facilitates clients to expedite product development through a distinct combination of ready-to-use technology blocks and services and matchless telecom experience. Sasken’s clients comprise the top 16 tier-one companies worldwide, with top ten customers accounting for 82.26% of the company’s total revenues. Some of Sasken’s clients also include Fortune 500 companies such as Nortel, Motorola, Nokia, Intel, Sony, NTT, Texas Instruments, Philips, Hitachi, Toshiba, Sharp, Fujitsu, etc. Mody hired four professionals who comprised the core group at Sasken. Sasken’s first client was Nortel, which was then a part of Bell Labs. The company bagged a huge order worth $40,000 for assisting Nortel in developing a translator for converting their models into VHDL. In 1999, Intel entered into a strategic deal with Sasken and funded it for working in the areas of multimedia and DSL. Intel is still one of the largest customers for Sasken. Sasken has grown from a small company into a global player. Today Sasken is No. 3 telecom player in the world. The company aspires to capture the No.1 spot by displacing TTP Com of UK. Says Mody, "Success in developing embedded systems depends not only on the availability of intellectual property components, but also on being able to integrate these components effectively so that the systems work. This is, without doubt, at the heart of our business." Sasken’s Services Sasken is India’s largest silicon Internet Protocol vendor, and provides semiconductor firms a range of licensable Internet Protocol solutions such as GSM, GPRS, and Internet Protocol services such as DSL, DSP, IC design, SoC, hardware design, and full chip design, and Universal Mobile Telecommunication System (UMTS) Protocol stacks, L1 Controller, and JBIG Silicon Internet Protocol. It provides product development services in the areas of physical layer services, system design services, analog front-end related services, network management, interoperability testing and data telemetry solutions. In addition, Sasken also offers services such as component design, product development and maintenance, and customizable solutions for high-bandwidth data telemetry applications. Sasken provides multimedia applications such as multimedia framework, codecs and wireless protocol stacks to terminal device manufacturers, while it offers them testing and verification, and platform and OS support services. Sasken offers domain expertise in wireless (2G, 2.5G, 3G), enterprise data communication, and mobile internet to the network equipment manufacturers. Sasken’s solutions are certified by ISO 9001:2000 quality, and the company has been assessed at CMM Level 5, the highest process quality certification in the world for software companies. Sasken’s proprietary intellectual property comprises its software, and the company depends on a portfolio of intellectual property such as trade secrets and copyrights, apart from services. Says Sunil D. Sherlekar, Chief Technology Officer, Sasken, “Services is a lucrative business, but we never wanted to depend upon it. Therefore we decided to enhance focus on creating IPRs in niche areas.” Hybrid Business Model Sasken followed a hybrid business model, which offered a combination of software products and services which complemented each other. Sasken’s hybrid business model is largely based on maximizing revenues through licensing of its intellectual property, and leveraging on its existing and new IPR portfolio. Says Dr G Venkatesh, "We were the first company in India to adopt a hybrid business model, in which we derive roughly half of our revenues through IP licensing and another half through services. Sasken firmly believes that this is the only viable business model that can be competitively sustained in the long run. Sasken has been able to differentiate itself from competition in the services space on account of the competencies it has built in the IP space. Likewise, Sasken has leveraged its services relationships to mature and propagate its IP licensing business." Sasken’s business model combines the value of intellectual property with a gamut of services through its various streams of business, viz., semiconductors, hand-held terminals, and networking equipment providers. Says Mody, “Financial markets don’t seem to understand our model. You don’t need a large amount of capital, you need a different attitude with capital. You have to stay focused and be patient. This is a long haul.” Mody feels that product companies have to come out with their own unique business models rather than aping globally successful models. In 2001, Sasken’s mobile software division contributed 30% to the company’s total revenues. This contribution is expected to increase further in the future, as Sasken is establishing strong relationships with suppliers in this area. On the customer front, Sasken added 27 new customers to its portfolio in 2002. Sasken’s services, including network services, contributed 85.97% of consolidated revenues for financial year 2005, while products businesses accounted for 14.03% of consolidated revenues. The consolidated revenues rose by 45.5% to Rs.2.42 billion in 2005, compared with the previous year. Says Vaibhav Parikh of Nishith Desai & Associates, “The beauty of IP is that unlike products, you do not need a high profile marketing plan to succeed in the market place. And unlike software services, IP can be used not only as a way to earn revenues from licensing but can also act as a competitive barrier to stop other companies from targeting your niche domain. Additionally, the same IP can also be used to provide services in a faster manner.” The Value of Innovation Sasken has been shaped by the corporate values of the company. Sasken’s key values that serve as the foundation of Sasken’s growth and governance are Integrity, Respect, Innovation, Customer Intimacy, and Excellence. Though the Indian R&D services and software product exports are in a fledgling stage, they are undergoing a gradual change. Kiran Karnik, President, NASSCOM, says, “If you look at the evolution of Indian software companies, you will notice that Indian companies are now looking at becoming truly global companies. One more distinct trend I see is the increasing thrust of software companies on IP creation and R&D services.” The Indian R&D services, which currently account for US$ 2.3 billion and is about 1.3% of the global market, is likely to grow rapidly because of the impetus provided by the strong global demand for embedded software and systems, and the increasing demand for offshore product development. According to the analysts’ prediction, the Indian R&D services and software products market is expected to grow to about US$ 8-11 billion by 2008-10. Sasken considers R&D as the life-blood of its business, and always accords due importance to it. According to Mody, commitment to research, patent filing, and protecting the inventions are key to Sasken’s business growth. Sasken established its corporate R&D group in 2001. A significant portion of its turnover is spent on R&D. Sasken invests about 5-8 percent of its total revenues on R&D. Sasken’s R&D expenses constituted 5% of the revenues during fiscal year 2002, and 4% during the fiscal 2001. However, though R&D expenses constituted 1% of the revenues in 2003 and 2004, in absolute terms, it increased by 75%. Sasken’s R&D investment for the year ended March 2004 increased by 66.77% to Rs.19.38 million from Rs.11.62 million in 2003. Sasken’s R&D investment for the period 2000-01 to 2004-05 was nearly Rs. 160 million. In 2003, Sasken focused its R&D in the areas of DSL, multimedia codecs and applications, and mobile platform solutions. Explaining the need for increased investment in IPR, Dr. G. Venkatesh, Chief Strategist at Sasken, says, "The IP licensing model requires sustained investments for a long period before significant payback can be expected. It also requires supporting activities like marketing at various forums, patenting and participation and influencing standards bodies." Sasken takes active part in technology working groups worldwide. Says Mody, “We have enough and more experience. Now, it’s time to build world-class products.” Sasken has always focused on R&D and innovation to create value through its intellectual property portfolio. The company started developing Intellectual Property in 1997. Sasken’s policy on IPR focuses on identification and protection of patentable ideas through filing of patents. With a strong intellectual property base, Sasken has partnered with big names such as Intel, Nortel Networks and Nokia Growth Partners, who have invested in them $4 million, $10 million and $3 million respectively. The company constantly encourages its employees to file for patents, as patents help transform R&D investments into economic benefits for the organization. Filing of patents constitutes a key aspect of the company’s business strategy. In 2002, Sasken also launched an innovation centre in Bangalore to give an impetus to the creation of new products ranging from hardware for internet access to 3G software solutions. Sasken, a pioneer in telecom R&D outsourcing, is the first Indian company to have more than 7 patents filed in the US. In 2002, Sasken filed 21 patent applications that included 12 provisional applications in India and the US, 6 non-provisional applications in the US, and 3 Patent Cooperation Treaty (PCT) applications. Sasken has also filed for the registration of its Trade Marks – ‘Sasken,’ ‘Aparate,’ and ‘IWAVE’ – in India, US, China, Japan, Russia, and the European Union. By March 2005, Sasken had filed a total of 32 patent applications, of which 5 were granted by the USPTO. The company had 27 patent applications pending in India, US, Europe, Japan and Korea. The number of PCT applications filed by the company rose to 6. Sasken now has more than 40 IPRs in its kitty. Sasken has also identified several new areas where intellectual property can be created, and which holds the key to Sasken’s growth and progress. According to Swaminathan, who is heading the central marketing organization at Sasken, the company’s key growth lies in its product innovation, customer intimacy, and operational excellence. However, Mody felt that creating intellectual property was not sufficient, and one needs to get enough insurance cover to protect their inventions from infringement and possible legal actions. Many Indian companies either have lack of adequate knowledge about IPRs or lack the mindset of filing patents to protect their intellectual property. Only few companies such as Sasken have strong legal teams to file patents for the company. Many companies hold a lot of valuable IPRs but never go for a comprehensive IPR audit to evaluate their IPRs, resulting in loss of tremendous potential opportunities. Mody opined that timely filing of patents is necessary for product companies to protect their valuable intellectual property rights. Extending Mody’s views, Sunil Desai, Technical Director (Engineering), Aftek Infosys, says, “IP certainly gives an edge over the competition as you can not only prove your technical prowess but also reduce delivery time by a significant percentage.” Sasken is engaged in the areas of Multimode, Wireless LAN, and software-defined radio. Says Sunil D Sherlekar, Chief Technology Officer (CTO) of Sasken, “The next logical step is to design a chipset and offer it through a licensing model.” Sasken was the first to market Wideband Code Division Multiple Access (WCDMA) stack protocols. Sasken has also developed GSM/GPRS protocol stack, a kind of telecom software, to garner more revenues. Protocol stacks are software components embedded in a mobile phone to facilitate and manage the communication link between the handset and the network. Sasken’s stacks are approved by Global Conformance Forum (GCF), thereby placing Sasken among the first companies to acquire the GCF approval for a telecom software product. Sasken’s emphasis on 3G communication by developing protocol stacks in the areas of GPRs, UMTS and Multimode has catapulted it as a leading player in the global telecom sector. Stack protocols now account for nearly 30% of Sasken’s sales revenues and are found in computers worldwide. In 2001, Sasken had important successes on the technology front with a GSM/GPRS protocol stack confronting the challenges of Field Trial Approval, and 3G stack triumph with key customers. Says Mody, “We are now regarded as one of the leading independent suppliers of protocol stacks in the world for next generation mobile terminals.” 3G protocol serves as an interface between the multiplexing and other transceiver circuitry in mobile handsets and enables 3G transmission. This technology, however, will be used only if it is included in the comprehensive 3G standard by 3GPP. And, if included in the standard, Sasken will be entitled to get royalties for each 3G handset sold in any part of the world until some other company comes up with an advancement and the standard is revised to better technology. Sasken has done significant work on IPRs. It is one of the only two independent sources for ADSL technology worldwide. The company owns the entire implementation IPR of the modem, as it has carried out the whole design in a bottom-up approach. In addition to ADSL, Sasken has a number of IPRs in 3G space and is currently the leading independent provider of protocol stacks in compliance with 3GPP specifications. Sasken is also one of the first companies in the telecom sector to have been granted patent in the DSL space, which is regarded as the first US patent in core communication technology granted to an Indian company. Licensing Revenue: The Big Kill On an average, Sasken makes about 55% of its revenues from IPR licensing, customization, and royalties, and the rest from services. In 2002, Sasken’s revenues from product licensing accounted for 47% of its total revenues, compared with 43% during the previous year. In 2005, Sasken earned Rs.30.4 million as royalties and Rs.156.2 million as licensing revenues from its intellectual property. Similarly, in 2004, royalties and licensing revenues from intellectual property contributed Rs. 9.4 million and Rs. 279.3 million respectively. Creation and protection of intellectual property also ensured steady growth in the sales and profits for Sasken. (Refer Table-2).

Sasken, which has created a prototype in the area of mobile 3G, is now planning to license it to a semiconductor company or a mobile phone manufacturing company. The company expects this stack to bring significant money every year through intellectual property licensing revenues. Sasken licenses its multimedia solutions to terminal equipment manufacturers and has an association with six of the ten global handset manufacturers. Sasken has licensed its ADSL technology to a multitude of suppliers, the prominent being Ambient, which was acquired by Intel. Sasken has adopted its multimedia component technology for NEC’s generation-next FOMA (NTT DoCoMo’s 3G service) phones. The company expects more than ten different models worldwide to run on Sasken’s intellectual property. The future for Sasken looks bright with the bottomline witnessing a healthy 30-35% growth rate. Says Mody, “We track our business by revenues generated from services and IPR separately. Our services business has been growing handsomely over the last 8 quarters at 21% growth per quarter.” Mody said he was proud of the achievements accomplished by Sasken on the IPR front. Sasken’s DSL IPR is deployed in about 400,000 lines. A phone that uses Sasken’s GSM/GPRS protocol stack was launched in China and tested in several global networks. Sasken’s multimedia application suites is currently present in 9-10 various handset models launched in the markets of Japan, China, UK, Australia, and Hong Kong. By focusing on IPRs and licensing, Sasken has gone from very humble beginnings to become a global player in a very short span of time. Call them trend-setters or pace-setters, but several companies will soon follow Sasken’s license-revenue model all the way. Banks better be ready.

Today's post comes from M. Qaiser and P. Mohan Chandran of iPrex Solutions, Hyderabad. Copyright © 2006, iPrex Solutions. All Rights Reserved.